medicare 101 - medicare basics and faq

What is Original Medicare?

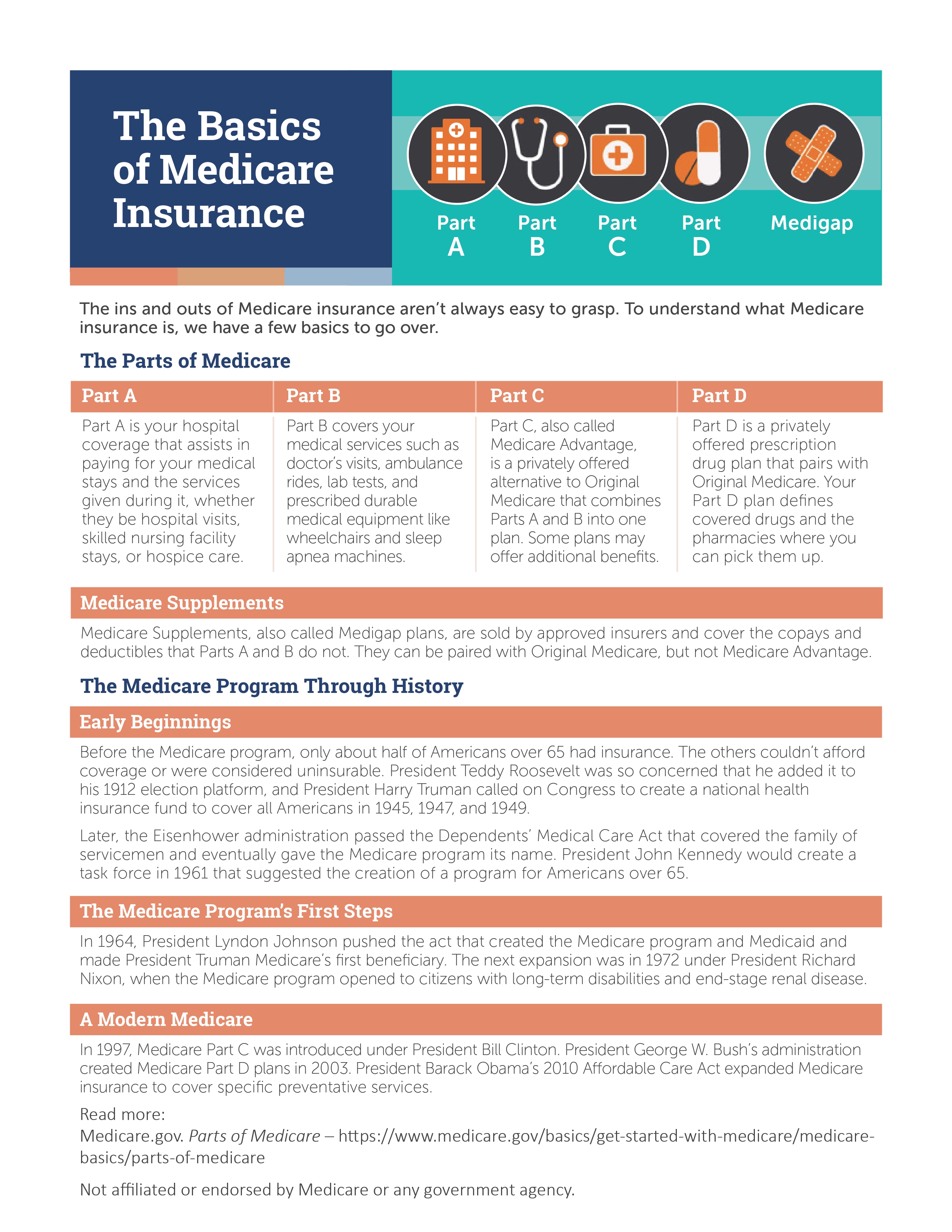

Medicare part A – Includes hospital coverage, skilled nursing facility care, hospice care and home health care. On its own, it can require co-pays and deductibles.

Medicare part B – Includes outpatient care, including services from doctors and other health care providers. It also covers some home health care, durable medical equipment (such as wheelchairs, walkers, hospital beds, and other equipment). It also covers many preventative services (such as screenings, shots or vaccines and yearly “Wellness” visits). On its own, it can include coinsurance and a deductible.

Who qualifies for Medicare?

People age 65 or older, certain people under age 65 with disabilities, and people of any age with end-stage- renal disease (ESRD) (permanent kidney failure requiring dialysis or a kidney transplant)

How much does Original Medicare cost?

Medicare Part A – Individuals age 65 or older may be entitled to a premium-free Part A. The individual or their spouse must have worked and paid Medicare taxes for at least 10 years. Individuals eligible for Medicare due to a disability, end-stage renal diseases (ESRD) or amyotrophic lateral sclerosis (ALS) also qualify for premium-free Part A.

If you don't qualify for premium-free Part A, you can buy Part A. People who buy Part A will pay a premium of either $278 or $505 each month in 2024, depending on how long they or their spouse worked and paid Medicare taxes. If you choose not to buy Part A, you can still buy Part B.

Medicare Part B - Most people will pay the standard premium amount ($174.70 for 2024). If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return. This is the most recent tax return information provided to Social Security by the IRS.

These IRMAA amounts can be found at https://www.medicare.gov/basics/costs/medicare-costs

Why would I purchase a Medicare supplement if I am on Original Medicare?

Not all costs are paid for under Original Medicare. For example, let's look at Medicare Part A. Say you have to go to an emergency room visit. Admission alone has a $1676 deductible for plan year 2025. After the deductible, Medicare pays 100% for the next 60 days of an inpatient stay. However, if the stay goes longer than that, Medicare will then start charging co-insurance from days 61 to 90. The amount for this in 2025 is $419 a day. If your stay is over 90 days, then the co-insurance goes up to $838 a day in 2025. These are called “lifetime reserve days.” What this means is that once these days are used up, Medicare will no longer pay for your inpatient stay. However, if you choose to buy a Medicare supplement Plan G (which we will be using as an example), then all of the above-mentioned costs will be paid in full. Also, when the “lifetime reserve days” run out, the Plan G will pay for an additional 365 days of coverage for an inpatient stay. Skilled nursing facilities also have a copay after the first 20 days. In 2025, this is $209.50 a day for the next 80 days (Maximum total of 100 days). Plan G will cover this copay.

As far as Medicare Part B goes, there is a calendar year deductible of $257 in 2025. After this has been paid, Medicare will generally pay 80% of the bill, while you pay the remaining 20%. It is important to note that some doctors can charge up to 15% extra for outpatient visits if they do not accept Medicare' s assigned amount. A Plan G supplement will pay for all of the Part B services mentioned above with the exception of the calendar year deductible.

In addition to all of that, a Plan G supplement also covers emergency care outside of the U.S. If you travel, this may be of use to you. Currently there is a lifetime maximum of $50,000 outside the U.S. With the Plan G paying 80% and you paying 20%.

As far as Medicare supplements are concerned, each company, by law, must provide the exact same benefit structure for each plan they sell. For example, if someone bought a Plan G from one company then the benefits would be the exact same from any other company offering Plan G. Since the coverage would be identical, and the main difference being cost of the premiums paid - we ask you this: "Why pay more than you have to?"

What are the other parts to Medicare?

The other parts to Medicare are Medicare Part D (for outpatient prescription drugs) and Medicare Part C (also known as Medicare Advantage, which works differently than Original Medicare and can also include prescription drug coverage). Unlike supplements, these are not fully standardized and may change benefits from year to year. Part C plans may add additional benefits that original Medicare does not cover such as dental and vision coverage. Enrollment in these plans are generally available during the Medicare Annual Enrollment Period (AEP) each year from October 15th through December 7th.

Should I get a Medicare Part D prescription drug plan?

Even if you don't currently take any prescriptions, it is advisable to buy a drug plan if you don't have what Medicare calls “creditable prescription drug coverage.” If you don't have some kind of creditable coverage, then you can get a (lifetime) penalty depending on how long you could have had such coverage but elected not to have it. Note: many Medicare Advantage plans include prescription drug coverage. These are called Medicare Advantage Prescription Drug Plans (MAPD).

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($34.70 in 2024) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $.10 and added to your monthly Part D premium. You can read more about these penalties on Medicare's website:

Note: Individuals who qualify for a low income subsidy or extra help may not have to pay this penalty.